About Me –

I am Shubhankar Jena, an independent securities market Researcher, passionate about deep company Analysis and sharing my research. My goal is to provide financial knowledge to readers so they can make informed investment decisions

My research is based on publicly available information and in-depth analysis. Please note that I am not a SEBI-registered financial advisor, and all information provided here is for educational purposes only.

If you are interested in the securities market and want to gain deep insights, let’s learn together and make this journey exciting!

PHARMACEUTICAL INDUSTRY

- THE INDIAN HEALTHCARE SECTOR – MARKET IS GROWING AT A RATE OF AROUND 16-17% (CAGR)ANNUALLY.

- GLOBAL PHARMACEUTICAL MARKET IS GROW AT A CAGR OF AROUND 6-7% OVER THE COMING YEARS

- U.S. PHARMACEUTICAL MARKET IS GROWING AT A CAGR OF AROUND 5.5% ANNUALLY.

- INDIAN PHARMACEUTICAL MARKET IS GROWING AT A CAGR OF AROUND 10% ANNUALLY

- GLOBAL MARKET SHARE: INDIA CONTRIBUTES APPROXIMATELY 20% OF THE GLOBAL PHARMACEUTICAL MARKET IN TERMS OF GENERIC DRUG SUPPLY.

- INDIA IS CALLED THE “PHARMACY OF THE WORLD”

- INDIAN PHARMACEUTICALS MARKET SIZE: (2024: $50 BILLION) (2030: $130 BILLION)

- GDP CONTRIBUTION: THE PHARMACEUTICAL INDUSTRY CONTRIBUTES AROUND 2% TO INDIA’S GDP

- AS PEOPLE AGE AND LIFESTYLE DISEASES INCREASE, THERE IS A GROWING NEED FOR MEDICINES TO TREAT LONG-TERM HEALTH

- 2021, THE AVERAGE PERSON IN THE UNITED STATES SPENT ABOUT $1,126 (₹93,458) ON MEDICINE.

- INDIA, THE PER CAPITA SPENDING ON MEDICINE IN 2021-22 WAS APPROXIMATELY ₹1,056. THIS IS MUCH LOWER COMPARED TO COUNTRIES LIKE THE UNITED STATES, WHERE THE COST IS SIGNIFICANTLY HIGHER.

- INDIA’S PHARMACEUTICAL INDUSTRY HAS BIG OPPORTUNITIES DUE TO LOW PER CAPITA SPENDING, A GROWING POPULATION, AND INCREASING HEALTHCARE DEMAND.

- IN TOTAL PHARMACEUTICAL PRODUCTION, INDIA RANKS AMONG THE TOP 5 COUNTRIES.

RPG LIFE SCIENCES LTD

RPG Group is a prominent business conglomerate in India, with a strong presence across various industries. Its headquarters is located in Mumbai, Maharashtra. The group was established in 1979 and primarily operates in sectors like power, retail, IT, and tire manufacturing.

Key Industries and Companies:

| Sl No. | Name | Industry |

| 1 | CEAT | Tyre |

| 2 | KEC International | Engineering |

| 3 | RPG Life Science | Healthcare |

| 4 | Summit Securities | NBFC |

| 5 | Zensar Technologies | Technology |

| 6 | STEL Holdings Ltd | Investment |

| 7 | Harrisons Malayalam | Agriculture |

- RPG Life Sciences: A company that manufactures pharmaceutical products and medicines.

- KEC International: A leading electrical construction company that works globally in power, transportation, and other infrastructure projects.

- Ceat Tyres: A major tire manufacturing brand under RPG Group, producing high-quality tires for both the Indian and international markets.

- RPG Transmission: A company involved in the manufacturing of power transmission equipment.

RPG LIFE SCIENCES LTD – BRIEF OVERVIEW:

RPG Life Sciences is part of the RPG Group, engaged in the manufacturing and marketing of pharmaceuticals (finished dosage forms) and Active Pharmaceutical Ingredients (APIs) in domestic and international markets. It operates in sectors like infrastructure, tyres, IT, and energy. The company is led by HARSH GOENKA.

KEY SEGMENTS:

- Domestic Formulations (67% revenue): Manufactures and markets branded products in India and Nepal (e.g., Azoran, Naprosyn).

- International Formulations (18% revenue): Operates in markets like Canada, UK, Germany, and Australia.

MANUFACTURING:

- 2 formulation units in Gujarat and 1 API unit in Navi Mumbai.

RECENT DEVELOPMENTS:

- Launched 6 new products in FY23 and 12 in FY24.

- Focused on digital coverage with 90,000+ doctors on “RPGserv.” – App Review – 4.4* Download 10k+

FUTURE OUTLOOK:

- Exploring growth through mergers & acquisitions and new product launches.

BUSINESS ANALYSIS

INDUSTRY & SECTOR: GROWTH POTENTIAL, TRENDS, AND COMPETITION

INDUSTRY OVERVIEW:

RPG Life Sciences Ltd pharmaceuticals और life sciences क्षेत्र में काम करता है। यह क्षेत्र healthcare needs, aging population, और medical technology advancements से प्रेरित है। फार्मास्युटिकल उद्योग का दीर्घकालिक विकास मजबूत है क्योंकि दवाओं की मांग हमेशा बनी रहती है।

GROWTH POTENTIAL:

The Indian pharmaceutical industry is benefiting from key government initiatives:

- 100% FDI: Permitted in health and medical services to attract global investments.

- PLI Schemes: Boosting domestic manufacturing and exports.

- National Health Policy 2017: Focused on affordable healthcare and quality improvement.

- Increased Health Expenditure: Target to raise healthcare spending to 2.25% of GDP by 2025.

- These initiatives are expected to strengthen the pharmaceutical sector and create growth opportunities.

TRENDS:

- Digital health और telemedicine का उभार, जो फार्मास्युटिकल कंपनियों के लिए नए अवसर बना रहा है।

- Regenerative medicine (जीन थेरेपी और स्टेम सेल रिसर्च) में विकास।

- Generics (जेनेरिक दवाएँ) की बढ़ती मांग, खासकर जब पेटेंट समाप्त होते हैं।

COMPETITION: Companies such as Sun Pharma, Cipla, and Lupin Pharmaceuticals are major competitors in the pharmaceutical industry. RPG Life Sciences gains a competitive edge through its high-quality products and R&D pipeline.

BUSINESS MODEL: REVENUE SOURCES, MARKET SHARE, KEY PRODUCTS/SERVICES

REVENUE SOURCES: RPG Life Sciences के प्रमुख राजस्व स्रोत:

- Pharmaceuticals: दवाओं का निर्माण और विपणन, खासकर cardiology, orthopedics, और gynecology में।

- APIs (Active Pharmaceutical Ingredients): अन्य कंपनियों को API की आपूर्ति।

- Export Market: international markets जैसे अमेरिका और यूरोप से आय का एक महत्वपूर्ण हिस्सा।

MARKET SHARE: Not Available

KEY PRODUCTS/SERVICES:

- Cardiovascular diseases (Dil se related problems)

- Diabetes

- Neurology (Dimaagi beemariyan, jaise ki epilepsy, Alzheimer’s)

- Orthopedic conditions (Haddi-joint se related problems)

- Gastroenterology (Pet se related problems, jaise acidity, ulcers)

- Oncology (Cancer ke ilaj ke liye)

- Respiratory diseases (Saans lene mein problem, jaise asthma, COPD)

- Formulations: गोलियाँ, कैप्सूल, इंजेक्टेबल्स, और टॉपिकल अनुप्रयोग।

- Therapeutic Areas: Cardiology, Orthopedics, और Gynecology में विशेषज्ञता।

- APIs: उच्च गुणवत्ता वाले API का उत्पादन और आपूर्ति।

- RPG Life Sciences Ltd पेटेंट मेडिसिन नहीं बना रही है, बल्कि जेनेरिक मेडिसिन और APIs (Active Pharmaceutical Ingredients) का निर्माण और विपणन कर रही है।

- कंपनी का BUSINESS MODEL लागत प्रभावी निर्माण, STRONG R&D, और GLOBAL PHARMACEUTICAL MARKET में रणनीतिक साझेदारियों पर आधारित है।

FINANCIAL STATEMENT

All amounts in Indian Rupees crore

| BALANCE SHEET | 2024 | 2023 |

| ASSETS | ||

| Non-Current Assets | 214cr | 155cr |

| Current Assets | 298cr | 264cr |

| Total Assets | 512cr | 419cr |

| EQUITY | ||

| Equity Share Capital | 13cr | 13cr |

| Other Equity | 361cr | 294cr |

| Total Equity | 374cr | 307cr |

| LIABILITIES | ||

| Non-Current Liabilities | 7cr | 8cr |

| Current Liabilities | 130cr | 102cr |

| Total Liabilities | 138cr | 111cr |

| Total Borrowings | 00 | 00 |

| Total Equities and Liabilities | 512cr | 419cr |

| P&L STATEMENT | 2024 | 2023 |

| TOTAL INCOME | ||

| Revenue From Operations | 582cr | 512cr |

| Other Income | 7cr | 4cr |

| Total Income | 589cr | 517cr |

| EXPENSES | ||

| Total Expenses | 471cr | 425cr |

| Profit Before Tax | 117cr | 91cr |

| Income Tax Expense | 30cr | 24cr |

| PROFIT FOR THE YEAR | 87cr | 67cr |

| CASH FLOW STATEMENT | 2024 | 2023 |

| CFO – Cash Flow from Operating Activities | 94cr | 90cr |

| CFI – Cash flow from Investing Activities | -79cr | -105cr |

| CFF – Cash flow from Financing Activities | -20cr | -17cr |

| Net Cash Flow | -5cr | -32cr |

BALANCE SHEET

- The company’s long-term assets have increased compared to the previous year, which is a positive sign. The main reason for this increase is the rise in Capital work-in-progress. This could be because the company has invested in new projects or infrastructure for future growth, which is not yet completed but will support the company’s long-term development.

- the company’s current assets have increased compared to the previous year, with inventory contributing the most to this increase. this means that the company has more inventory this year than last year, which is a positive sign. it indicates that the company has increased its stock, potentially improving sales and operations in the future.

- The company’s current assets have increased over non-current assets, indicating that, as a pharmaceutical company, it has boosted its stock to meet future demand, which is a positive sign.

- The company’s total assets have also increased compared to the previous year, indicating overall growth and better resource accumulation.

- The increase in other equity suggests the company has reinvested its profits, which is a positive sign of growth.

- The company’s total equity value is higher this year compared to the previous year, indicating that the company has strengthened its financial position.

- The company has set aside long term ₹4 crore as provisions for future emergencies, ensuring financial security.

- The company’s non-current liabilities have decreased from ₹8 crore to ₹7 crore, indicating a reduction in long-term liabilities.

- The best part is that the company has zero debt, indicating strong financial stability.

- The company’s trade payables are 0, indicating timely payments to suppliers with no outstanding dues.

- Other financial liabilities are higher compared to the previous year, as the company incurred higher expenses in Employee Benefits Payable than last year.

- The company has set aside long term ₹12 crore as provisions for current emergencies, ensuring financial security.

- The company’s current liabilities have increased from ₹102 crore last year to ₹130 crore this year, indicating a rise in short-term obligations.

- Total liabilities last year were ₹111 crore, and this year they have increased to ₹138 crore, indicating a rise in the company’s overall obligations.

P&L STATEMENT

- Revenue from operations has increased from ₹512 crore last year to ₹582 crore this year, and other income has risen from ₹4 crore to ₹7 crore. Overall, the company’s revenue has increased.

- The company earned ₹1 crore by selling mutual funds, & Fair value gain on financial instruments at fair value through profit or loss (“Mark-to-Market Gain”) 4cr which contributed to the increase in other income.

- If we talk about expenses, the COGS (Cost of Goods Sold) has increased from ₹86 crore last year to ₹120 crore this year. The main reasons for this increase are:

Raw Material Consumed, which rose from ₹71 crore to ₹103 crore.

Packaging Material Consumed, which increased by ₹2 crore.

These factors have contributed significantly to the rise in COGS.

- Employee benefits expense this year is higher compared to last year, as the company has paid higher salaries to its employees.

- Other expenses are higher this year compared to last year, indicating that the company is investing in its operational activities.

- Total expenses this year have also increased compared to last year, reflecting higher costs in various areas of the company’s operations.

- After subtracting all expenses (including taxes) from revenue, the net profit is ₹87 crore, compared to ₹67 crore last year. This means the company has earned ₹20 crore more this year, which is a positive sign.

- EPS (Earnings Per Share) has also grown, reflecting the increase in net profit. This indicates better profitability per share compared to the previous year.

- Looking at the P&L statement, everything seems to be improving. Revenue has increased, expenses have been well-managed, and both net profit and EPS have grown, indicating strong financial performance.

CASH FLOW STATEMENT

- CFO- Cash from Operating Activity

- CFO (Cash Flow from Operations) has increased compared to the previous year.

- It is positive, which is a good sign for the company.

- CFO is higher than the net profit, indicating strong cash generation from core operations.

- Cash from Investing Activity

- No Revaluation: Property, plant and equipment, intangible assets and right-of-use assets were not revalued this year.

- Security Mortgage: Second charge has been placed on the company’s land, building and plant-machinery for working capital loan of ₹5,250 lakh. (52cr)

- The company has spent twice as much on Property, Plant, and Equipment this year compared to the previous year. This investment is primarily in land, buildings, and plant machinery, aimed at strengthening the company’s future growth.

- MANUFACTURING:2 formulation units in Gujarat and 1 API unit in Navi Mumbai

- The company has sold Property worth only ₹1 crore this year. No problem

- Last year, the company invested ₹56 crore in mutual funds, which decreased to ₹43 crore this year. Additionally, while no mutual funds were sold last year, the company sold ₹17 crore worth of mutual funds this year. This indicates a balanced approach rather than a negative trend.

- In terms of investing activities, the company has spent –₹79 crore this year, lower than last year’s –₹105 crore, indicating a positive shift towards focusing on internal business growth. The highest investment has been in Property, Plant, and Equipment, signaling a strong focus on long-term expansion and improving infrastructure for future growth.

- Cash from Financing Activity

- The company has paid a slightly higher dividend this year compared to last year, which is a positive sign. This move could be aimed at attracting investors and gaining their confidence in the company.

- The cash flow from financing activities is negative, which means the company is repaying its debt or paying dividends, indicating that the company is strengthening its financial position.

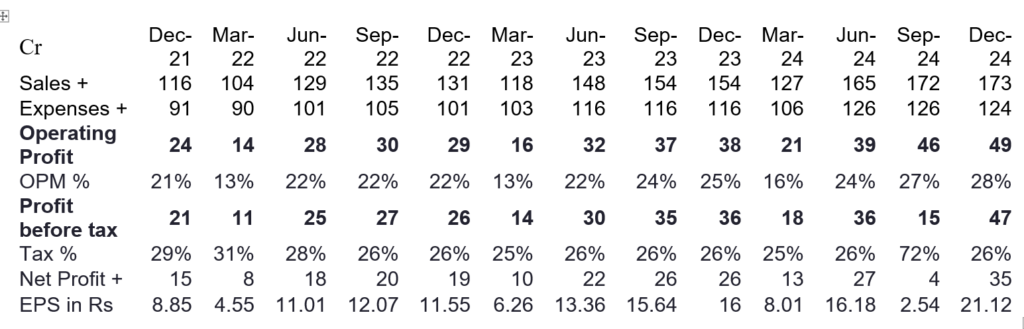

QUERTERLY RESULT

RPG LIFE SCIENCE – COMPLETE INFORMATION

Corporate Overview

- RPG Life Sciences was founded in 1993 and got listed on the stock market in 1999.

- RPG stands for Rama Prakash Gupta. The name RPG Life Sciences is derived from the founder’s name.

- RPG Group is a global diversified business group with operations in the areas of Infrastructure, Tyres, Information Technology, Pharmaceuticals, Energy, Plantations and Venture Capital. Founded by the legendary industrialist Dr RP Goenka, the Group’s lineage dates to the early 19th century. Today, RPG has several companies in core sectors of the economy: the most prominent among them being KEC International, CEAT, Zensar Technologies, RPG Life Sciences and Harrisons Malayalam. One of India’s fastest growing business groups, the RPG name is synonymous with stability, steady growth, high standards of corporate governance and a culture of respect for people and the environment

- RPG Life Sciences is an integrated pharmaceutical company operating in the Domestic and International markets in the Branded Formulations, Global Generics, and Synthetic APIs

- 50+ Countries market presence

- 1200+ Employees across locations

- 50+ year of rich legacy

- Revenue mix by categories – *API 15%, *International Formulations 18%, *Domestic Formulations 67%

- Key Geographies – • Canada • UK • Germany • France • Australia • Myanmar • Philippines • Egypt • Colombia • South Africa • Mexico • Brazil • India • Germany • Russia • Poland • China • Japan

- Key Products- Immunosuppressant basket – Azathioprine, Mycophenolate Mofetil

Chairman’s Message Harsh V. Goenka

- The Indian pharmaceutical market is expected to grow at about 10% per annum

- For FY24, RPG Life Sciences was the 7th fastest growing company among the Top 75 pharmaceutical companies in India

- The company’s long term credit rating was also upgraded by ICRA to A+ during the year

MD’s Message – Yugal Sikri

- In FY24, we achieved strong performance with revenue of ₹582.1 crores, growing 14% YoY. EBITDA, PBT, and PAT rose by 26%, 29%, and 30%, respectively. Margins improved: EBITDA at 23.3% (from 21.0%), PBT at 20.2% (from 17.9%), and PAT at 15.1% (from 13.2%).

- RPG Life Sciences has been ranked as the 7th fastest growing company among the top 75 companies in the Indian Pharmaceutical Marke

- FY24 marked the 5th year of our Transformation Journey of consistent, uninterrupted, upward trajectory of Sales, EBITDA, Margins, ROCE, ROE, EPS and Cashflows with our company emerging as a benchmark company amongst the comparator companies in a number of key financial metrics viz. Margin, Leverage, Return, Liquidity and Valuation ratios

- We also recognize our responsibility towards society at large and continue to engage in various CSR initiatives to encourage the sustainable development of communities

Boards’ Report

| Metric | FY20 | FY21 | FY22 | FY23 | FY24 |

| Revenue from Operations (₹ crores) | 375.57 | 383.14 | 440.16 | 512.81 | 582.05 |

| Cash from Operations | 56.60 | 66.66 | 83.60 | 116.05 | 123.67 |

| EBITDA Margin (%) | 15.6 | 18.2 | 18.3 | 21 | 23.3 |

| PBT (₹ crores) | 36.45 | 53.56 | 63.35 | 73.17 | 117.84 |

| PBT Margin (%) | 9.7 | 13.8 | 14.6 | 17.9 | 20.2 |

| PAT (₹ crores) | 29.01 | 40 | 51.48 | 67.64 | 87.66 |

| PAT Margin (%) | 7.7 | 10.3 | 11.7 | 13.2 | 15.1 |

| EPS (₹ per share) | 17.54 | 21.43 | 31.13 | 40.9 | 53.01 |

| Dividend (%) | 50 | 90 | 120 | 150 | 200 |

- The company is upgrading and expanding its three plants—one API plant in Navi Mumbai and two Formulations plants in Ankleshwar—by spending over ₹100 crores. This will help grow its International Formulations and API businesses.

- ICRA- Long term rating upgraded to A+ (Stable) from A (Stable) Short term rating reaffirmed at A1

- Your Directors recommend a dividend of 16/- (200%) per equity share for the financial year ended March 31, 2024. (face value basis)

- The company earned ₹589 crores in total income and ₹87 crores in profit after tax this year, compared to ₹517 crores and ₹67.64 crores last year. The growth was driven by strong performance in Domestic and International Formulations businesses.

- The company generated over 15% higher revenue this year from Domestic Formulations Business and International Formulations Business compared to the previous year.

Management Discussion and Analysis Report

- The Indian Pharmaceutical Market (IPM) is now valued at 2,16,091.7 crores with a year-on-year value growth of 7.6%

- India is expected to break into top 10 countries in terms of spend on medicines as the spending is expected to grow at about 10% annually over the next five years.

- Indian pharmaceutical industry has seen a gradual increase in government healthcare spending and expansion of the private hospital sector. Government initiatives such as allowing 100% Foreign Direct Investment (FDI) in health and medical services and PLI schemes are benefiting the pharma industry.

- The Government also plans to increase health expenditure to 2.25% of GDP by 2025. This is also expected to give a boost to the pharmaceutical sector.

- Debt-free Company

- key brands i.e. – Azoran, Aldactone, Lomotil, Naprosyn, Serenace, Norpace, etc. It has a presence in various therapeutic segments such as Cardiologists, Diabetologists, Urologists, Nephrologists, Rheumatologists, Oncologists and others.

- APIs Segment (15% of revenues)

- Capex of Rs. 51 Cr. incurred on the plant modernization and statutory payment. Large part of capex is completed.

- Company continues to focus on increasing its presence in existing geographies through new product launches, and on exploring new markets

RATIO ANALYSIS

- RPG Life Sciences: A small-cap company with potential to grow into a large-cap.

- RPG Life Sciences:ROCE&ROE consistently >15% over the past 10 years, indicating strong capital efficiency and growth potential.

- Current Ratio > 1, indicating a strong position.

- Interest Coverage Ratio > 3x, indicating the company’s ability to comfortably Pay interest expenses.

- Debt-to-Equity Ratio is zero, indicating Zero Debt on the company’s

- P/E Ratio is 40, indicating a higher valuation compared to its 3-5year average and the industry average.

- Price-to-Book (P/B) Ratio > 1, which is higher than both its industry and historical average, indicating a higher market valuation.

- PEG Ratio is less than <1, meaning the stock may be undervalued

- The company has zero Debt, reflecting a Debt-free company.

- Contingent liabilities are very low, indicating minimal financial risk.

- Promoter holding of 72.8%, which has continued to grow, indicating increasing confidence and commitment by the promoters.

- No promoter pledging, indicating that promoters have not pledged their shares

- Company is providing a strong dividend of 200% of the face value (₹16 on a face value of ₹8)

- The company has positive free cash flow, with a consistent average of positive free cash flow over the past 10 years, indicating strong cash generation

MOST IMPORTANT THINK

- The pharmaceutical industry currently has a growth potential of over 10%, indicating strong growth in India.

- The company is a small-cap with significant growth opportunities.

- GDP Contribution: The pharmaceutical industry contributes about 2% to India’s GDP.

- In other countries, spending on medicines is much higher than in India. This means that in India, per capita spending on medicines is expected to rise, leading to further growth in the pharmaceutical industry.

- in total pharmaceutical production, india ranks among the top 5 countries.

- The pharmaceutical industry is growing with increasing demand, and the Indian government is also supporting various scheme the industry.

- Due to changing lifestyles and rising diseases, the pharmaceutical industry has a big opportunity to help improve health.

- The Indian pharmaceuticals market size is expected to grow from $50 billion in 2024 to $130 billion by 2030.

- Increased Health Expenditure: The goal is to increase healthcare spending to 2.25% of GDP by 2025.

- The company is a pharmaceutical firm involved in manufacturing generic medicines and APIs, with a global footprint in 50+ countries

- 3 Manufacturing Facilities

- The company’s business is not just limited to India, but it also operates in many countries around the world, which is a positive sign.

- The company is increasing its capital expenditure to expand its business, which is significantly higher than the previous year. This could be a positive sign

- The company’s financial statements are strong and have no issues.

- The company has zero debt.

- Environmental considerations: RPG does not face any major physical climate risk.

- Domestic Formulations: 67% of the revenue comes from domestic formulations, while International Formulations contribute 18% of the revenue.

- For FY24, RPG Life Sciences was the 7th fastest growing company among the Top 75 pharmaceutical companies in India

- The company’s ratios are overall strong and healthy; however, two ratios, the P/E ratio and P/BV ratio, are slightly overvalued.

- The GPM (Gross Profit Margin), OPM (Operating Profit Margin), and NPM (Net Profit Margin) are also stable.

- The Price to Book Value (P/BV) ratio is overvalued compared to the median P/BV. (3yr,5yr)

- The PE Ratio is Overvalued compared to the median PE ratio (3yr,5yr)

- Company is providing a strong dividend of 200% of the face value (₹16 on a face value of ₹8)

- The company’s quarterly results show consistent growth in both revenue and net profit each quarter, which is a positive sign.

- Since 2020, the company’s sales, operating profit, and net profit have all shown strong growth.

- The company’s topline growth and bottomline growth continue to be more than 10% annually.

- The company’s EPS (Earnings Per Share) is also consistently increasing.

- The company’s reserves are continuously growing, which is a positive sign. If the company faces any issues, it can easily manage by utilizing its reserves.

- The best part is that the company has had zero debt since 2022, which is a very positive sign.

- The company’s fixed assets have been continuously growing, maintaining stability, which indicates solid investment in its infrastructure and long-term growth

- From 2013 to the end of 2022, the company made no investments. However, in 2023 and 2024, the company has made significant investments, which is a positive sign for future growth.

- The company’s CFO (Cash Flow from Operations) is positive and showing consistent growth, and it is consistently higher than the net profit, which is a strong financial indicator.

- Talking about CFI (Cash Flow from Investing), the company has made significant investments in the past 2 years. In fact, the company has invested more in 2023 and 2024 alone than it did in the entire 8 years prior, reflecting a strong commitment to business growth.

- Debtor days have decreased, showing improved payment collection and better cash flow management.

- Days Payable are almost constant, indicating stable payment practices and consistent management of payables.

- The company’s inventory days have been continuously increasing, which is not a good sign.

- The promoter’s holding has increased and is consistent.

- The promoter has not pledged any shares and not share sell, which indicates confidence in the company’s performance and financial stability.

- The holding of FII (Foreign Institutional Investors) and DII (Domestic Institutional Investors) has been steadily increasing, reflecting growing institutional confidence in the company’s prospects.

- The public’s holding has decreased, which is a good sign as it shows more confidence from institutional investors and promoters.

- There is no fraud case against Rapag Life Sciences company promoter Harsh Goenka.

THE RATING UPGRADATION FACTORS:

• Strong brands in the Indian Pharmaceutical Industry

• RPG Life Sciences Limited: Long-term rating upgraded to [ICRA]A+(Stable) and shortterm rating reaffirmed at [ICRA]A1

VALUATION

My name is Shubhankar Jena, and I am an independent securities market researcher. I have recently researched RPG Life Sciences. RPG Life Sciences is a strong company in the pharmaceutical industry. The company’s business, business quality, and financial position are all strong. It has good inside ownership, and all important ratios are positive. The company is debt-free, and there are many other good things about it. Overall, the company is good, but it is currently overvalued. We can wait until it becomes undervalued

.

Shubhankar Jena

The Research was Conducted by Shubhankar Jena